The Scanner, Jan’26 | Gold and Silver : Opportunity or overheating?

When prices rise very quickly, they often pause, or correct. In such moments, slowing down and staying … Continued

Read more31 January 2024

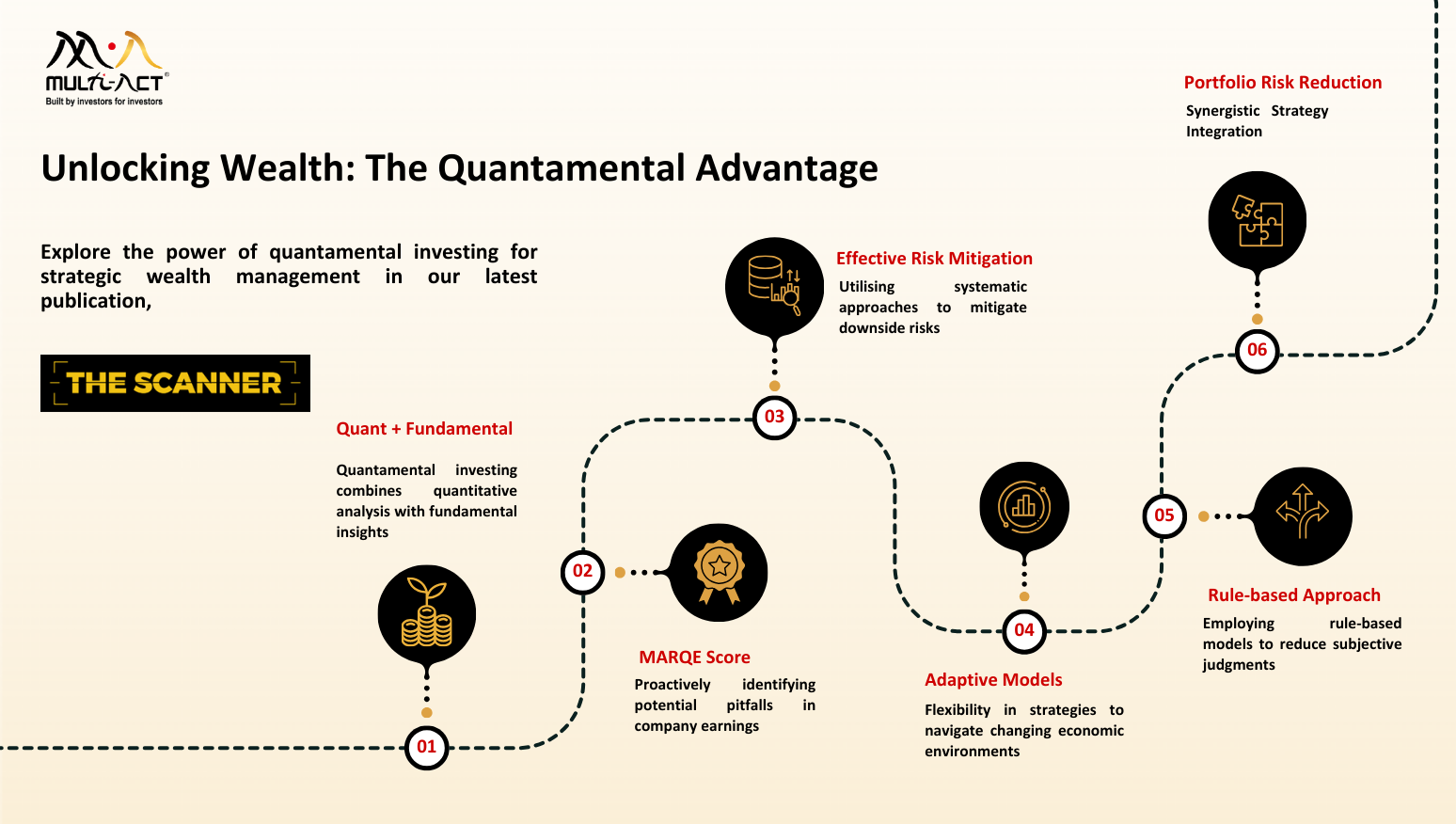

Enhance your investment strategy with quantamental investing – a dynamic fusion of quantitative analysis and fundamental insights. This approach integrates data-driven decision-making, automation efficiency, enhanced risk management, scalability, adaptability, and minimised behavioral biases.

Despite challenges such as data quality and complexity, our experience shows that a systematic and flexible application can yield substantial benefits.

In 2024’s first edition of the Scanner, we delve into the future of wealth creation and preservation by adopting a layered approach to portfolio construction. Prannoy Bhargava, Multi-Act’s Deputy Head of Research and Senior Research Analyst, explores the strengths of both quantitative and fundamental analysis for a comprehensive understanding of investment opportunities.

When prices rise very quickly, they often pause, or correct. In such moments, slowing down and staying … Continued

Read more

2025 did not challenge growth. It challenged assumptions. As expectations moved ahead of actual delivery, prices adjusted … Continued

Read more

Macro numbers alone rarely tell the full story. When jobs, consumption, credit, and inflation are considered together, … Continued

Read moreReceive monthly updates by signing up to our newsletter.

|

Sr. No. |

Received from |

Pending at the end of last month |

Received |

Resolved* |

Total Pending # |

Pending complaints > 3 months |

Average Resolution time^ (in days) |

|

1 |

Directly from Investors |

0 |

0 |

0 |

0 |

0 |

0 |

|

2 |

SEBI (SCORES) |

0 |

0 |

0 |

0 |

0 |

0 |

|

3 |

Other Sources (if any) |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

Grand Total |

0 |

0 |

0 |

0 |

0 |

0 |

Number of complaints received during month against the IA due to impersonation by some other entity:

Note: In case of any complaints received against the IA due to impersonation of the IA by some other entity, the IA may adjust the number of such complaints from total number of received/resolved complaints while preparing the above table. Further, IA must close such impersonation related complaints after following the due process as specified by SEBI/ IAASB.

* Inclusive of complaints of previous months resolved in the current month.

# Inclusive of complaints pending as on the last day of the month

^ Average Resolution time is the sum total of time taken to resolve each complaint in days, in the current month divided by total number of complaints resolved in the current month.

|

Sr. No. |

Month |

Carried forward from previous month |

Received |

Resolved* |

Pending# |

|

1 |

April, 2025 |

0 |

0 |

0 |

0 |

|

2 |

May, 2025 |

0 |

0 |

0 |

0 |

|

3 |

June, 2025 |

0 |

0 |

0 |

0 |

|

4 |

July, 2025 |

0 |

0 |

0 |

0 |

|

5 |

August, 2025 |

0 |

0 |

0 |

0 |

|

6 |

September, 2025 |

0 |

0 |

0 |

0 |

|

7 |

October, 2025 |

0 |

0 |

0 |

0 |

|

8 |

November, 2025 |

0 |

0 |

0 |

0 |

|

9 |

December, 2025 |

0 |

0 |

0 |

0 |

|

10 |

January, 2026 |

0 |

0 |

0 |

0 |

|

|

Grand Total |

0 |

0 |

0 |

0 |

*Inclusive of complaints of previous months resolved in the current month. #Inclusive of complaints pending as on the last day of the month.

|

SN |

Year |

Carried forward from previous year |

Received |

Resolved* |

Pending# |

|

1 |

2021-22 |

0 |

0 |

0 |

0 |

|

2 |

2022-23 |

0 |

0 |

0 |

0 |

|

3 |

2023-24 |

0 |

0 |

0 |

0 |

|

4 |

2024-25 |

0 |

0 |

0 |

0 |

|

|

Grand Total |

0 |

0 |

0 |

0 |

*Inclusive of complaints of previous years resolved in the current year. #Inclusive of complaints pending as on the last day of the year.