The Scanner, Jan’26 | Update: Gold and Silver

Gold and silver are no longer just rallying. They are stretching. When prices move materially beyond historical … Continued

Read more7 January 2025

Warren Buffett famously remarked, “Investing is simple, not easy,” succinctly capturing the challenge of disciplined investing. While the foundational principles—buying quality assets, assessing valuations, and exercising patience—seem straightforward, their application often proves anything but. Investors face an unrelenting barrage of distractions: sensational news headlines, unpredictable geopolitical events, and the unpredictability of market sentiment. These external forces can sway even the most experienced investors, transforming rational decisions into emotional reactions. The “Buffett Conundrum” lies in this disconnect between the simplicity of the rules and the complexities of real-world execution.

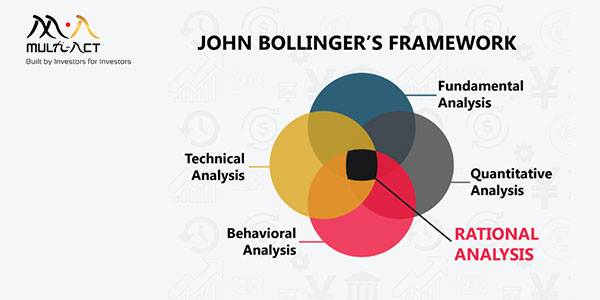

GRAF: A Comprehensive Investment Framework

How can investors navigate these challenges? The Global Rational Analysis Framework (GRAF) offers a structured approach that integrates multiple lenses of analysis. Rather than relying on a single perspective, GRAF combines complementary methodologies to uncover deeper insights:

This multidimensional approach ensures a balanced and informed view of the investment landscape, reducing the likelihood of over-reliance on any single method.

Building Blocks of Success: The Three Pillars of Investment

At its core, GRAF rests on three fundamental questions that form the foundation of investment decisions:

Behavioural Biases: The Invisible Hand Shaping Markets

Markets are not just a product of numbers; they are profoundly influenced by human behaviour. Psychological tendencies—such as anchoring, herd mentality, and loss aversion—create cycles of over-optimism and unwarranted pessimism. Consider the sharp decline in oil prices in 2020, which led many to prematurely declare the end of the commodity cycle. Yet, historical context revealed that such levels were likely unsustainable. By incorporating behavioural insights, GRAF separates market noise from meaningful signals, fostering a clearer understanding of long-term fundamentals.

The Art of Timing: Where Patience Meets Analysis

Patience is often hailed as a hallmark of successful investing, but patience without a robust framework can lead to inertia. GRAF transforms timing into a data-driven endeavour, aligning the outcomes of its various analyses. Fundamental insights guide the identification of undervalued opportunities, technical indicators suggest optimal market conditions and behavioural analysis helps gauge sentiment extremes. The result is a thoughtful, evidence-based approach to timing, reducing reliance on intuition.

Sleeping Well at Night: The Assurance of GRAF

In an investment world often characterised by unpredictability, GRAF offers a structured pathway to informed decision-making. By addressing the interplay of fundamental value, market dynamics, and human behaviour, it aims to instil confidence in the investment process. While no framework can eliminate uncertainty, GRAF’s disciplined methodology provides a solid foundation for navigating volatility with resilience and rationality.

The “Buffett Conundrum” underscores that success in investing isn’t about simplicity alone but about marrying simplicity with a systematic approach. GRAF is a framework designed to guide investors through the complexities of modern markets, balancing diverse perspectives with a disciplined process.

Statutory Details: Multi-Act Trade and Investments Private Limited (“MATI”) (SEBI Registered Investment Adviser – Registration No. INA000008589 and BASL Membership ID:- 1398)

Disclaimer: This article and the views expressed therein has been made solely for information and educational purpose only. MATI or the employee does not solicit any course of action based on the information provided by it and the reader is advised to exercise independent judgment and act upon the same based on its/his/her sole discretion based on their own investigations and risk-reward preferences. The information in the article is meant for general reading and understanding purpose and is not meant to serve as a professional guide. The article is prepared on the basis of publicly available information, internally developed data and from sources believed to be reliable. This article and its contents are property of MATI, and no part of it or its subject matter may be reproduced, redistributed, passed on, or the contents otherwise divulged, directly or indirectly, to any other person (excluding the relevant person’s professional advisers) or published in whole or in part for any purpose without the prior written consent of MATI. If this article has been received in error, it must be returned immediately to MATI. MATI, its associates or any of their respective directors, employees, affiliates, or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such views and consequently are not liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way for decisions taken based on this article.

For other Disclosures, please click https://multi-act.com/services/investment-advisory/

Gold and silver are no longer just rallying. They are stretching. When prices move materially beyond historical … Continued

Read more

When prices rise very quickly, they often pause, or correct. In such moments, slowing down and staying … Continued

Read more

2025 did not challenge growth. It challenged assumptions. As expectations moved ahead of actual delivery, prices adjusted … Continued

Read moreReceive monthly updates by signing up to our newsletter.

|

Sr. No. |

Received from |

Pending at the end of last month |

Received |

Resolved* |

Total Pending # |

Pending complaints > 3 months |

Average Resolution time^ (in days) |

|

1 |

Directly from Investors |

0 |

0 |

0 |

0 |

0 |

0 |

|

2 |

SEBI (SCORES) |

0 |

0 |

0 |

0 |

0 |

0 |

|

3 |

Other Sources (if any) |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

Grand Total |

0 |

0 |

0 |

0 |

0 |

0 |

Number of complaints received during month against the IA due to impersonation by some other entity:

Note: In case of any complaints received against the IA due to impersonation of the IA by some other entity, the IA may adjust the number of such complaints from total number of received/resolved complaints while preparing the above table. Further, IA must close such impersonation related complaints after following the due process as specified by SEBI/ IAASB.

* Inclusive of complaints of previous months resolved in the current month.

# Inclusive of complaints pending as on the last day of the month

^ Average Resolution time is the sum total of time taken to resolve each complaint in days, in the current month divided by total number of complaints resolved in the current month.

|

Sr. No. |

Month |

Carried forward from previous month |

Received |

Resolved* |

Pending# |

|

1 |

April, 2025 |

0 |

0 |

0 |

0 |

|

2 |

May, 2025 |

0 |

0 |

0 |

0 |

|

3 |

June, 2025 |

0 |

0 |

0 |

0 |

|

4 |

July, 2025 |

0 |

0 |

0 |

0 |

|

5 |

August, 2025 |

0 |

0 |

0 |

0 |

|

6 |

September, 2025 |

0 |

0 |

0 |

0 |

|

7 |

October, 2025 |

0 |

0 |

0 |

0 |

|

8 |

November, 2025 |

0 |

0 |

0 |

0 |

|

9 |

December, 2025 |

0 |

0 |

0 |

0 |

|

10 |

January, 2026 |

0 |

0 |

0 |

0 |

|

|

Grand Total |

0 |

0 |

0 |

0 |

*Inclusive of complaints of previous months resolved in the current month. #Inclusive of complaints pending as on the last day of the month.

|

SN |

Year |

Carried forward from previous year |

Received |

Resolved* |

Pending# |

|

1 |

2021-22 |

0 |

0 |

0 |

0 |

|

2 |

2022-23 |

0 |

0 |

0 |

0 |

|

3 |

2023-24 |

0 |

0 |

0 |

0 |

|

4 |

2024-25 |

0 |

0 |

0 |

0 |

|

|

Grand Total |

0 |

0 |

0 |

0 |

*Inclusive of complaints of previous years resolved in the current year. #Inclusive of complaints pending as on the last day of the year.