Assessing the effectiveness of mutual fund categories in Indian portfolios

Amogh Korde, Project Lead – Behavioural and Fund Analytics at Multi-Act, delves into the ever-evolving investment landscape … Continued

Read more19 December 2018

While analyzing a company, a systematic approach to assess the Quality of Earnings is one of the important processes we follow to identify risks and minimize the chances of facing a permanent loss of capital.

The central idea in this example is “KYR” or “Know Your Risk”. Understanding risks can help in:

a. Furthering qualitative check on companies.

b. Bucketing companies along the “Certainty Curve”

c. Depending on risk appetite and mandate, position-sizing in the portfolio

In this case study, we highlight some observations made while studying a large India-based auto ancillary company as part of our regular research. This company has a global presence with more than 140 subsidiaries and associates. It has expanded into different geographies

and product lines over the last decade.

Operating Margins

The average operating margins for the company have been shifting from double-digit margins prior to FY 2009 to mid-single digits. This shift can be attributed to two major acquisitions carried out by the company in FY 2009 and FY 2012; both were low-operating margin businesses. The company has sacrificed profitability in order to expand its business (Revenue CAGR of the past 15 years has been ~39% vis-à-vis OP CAGR of ~34% CAGR and PAT CAGR at ~31%).

Debt-funded Acquisitions

a. The company has been able to carry out various acquisitions recently by raising money primarily through debt.

b. The company has been able to identify and acquire various targets at a valuation multiple of around 0.10-0.20 x EV /Sales. This raises two important questions :

i. How the company is able to acquire targets at such cheap valuations multiples

consistently?

ii. How sustainable is such “cheap” growth?

Based on some follow up / groundwork, it appeared that the management’s commentary in various public forums suggests that the company has been able to identify and acquire businesses with the help of its large OEM customers who identify the businesses and ask the company to evaluate and acquire. Generally, these businesses suffer from operational and financial difficulties which hamper OEMs’ supplies.

Conversion of Accounting Profits into Free Cash Flow (FCF)

The company has had very low FCF margins for the past few years. Even though the company has been reporting profits over the years it has not been able to generate substantial Free Cash Flow to the firm. Despite low FCF, the company has maintained its dividend payout ratio of around 30%.

The long-term average FCF/EPS ratio (conversion of profit to free cash) is low at 17%, which adjusted for acquisitions (inorganic growth) is -42.0%.

Thus, business requires continuous capital for growth.

Quality of Disclosures – Discounting of Trade Receivables

Starting in 2017, the company started to report discounting of its trade receivables. Similar disclosures were not available in earlier years’ annual reports. One cannot be sure if the company has resorted to bills discounting in previous years as well.

In the absence of old data, we are not certain how much bill-discounting has helped improve the company’s cash conversion cycle over the years.

Quality of Disclosures – Ind AS Adoption

The company has started reporting “Revenue from Tools” using “Percentage Completion Method” citing the application of Ind AS. But the company’s disclosures are inadequate and do not explain the reason for the particular nature of such revenues.

Generally, the percentage of completion method is used to recognize revenue in the case of capital goods companies or construction companies. (However, it later came to our knowledge that this has been a normal practice for such companies who work with OEMs

during the product development stage. OEMs allow auto ancillaries to charge for products developed by them in proportion to vehicles actually sold. Hence, conversion of inventory into receivables above. Thus, this may not be a source of concern).

Corporate Structure – Subsidiary Financials

The company has a complicated group structure and has 139 subsidiaries and 8 associates and JV as on 31st March 2018. Due to the complexity of the structure, the disclosures with regard to these subsidiaries have been limited and uneven.

There may be some inter-company eliminations, however. The above information shows how volatile the difference between reported consolidated net margins and summation of net margins based on annual report subsidiary information can be.

Peer Comparison

The company’s standalone business (mainly wiring harness in India) earns EBITDA margins of 18-20%. This is similar to the margins earned by Bosch / Wabco in India which are perceived to have higher technology-intensive products. Similarly, there are other auto ancillary companies earning higher margins due to customer relations, high market shares, and so on. Though this may be the case, one needs to qualitatively analyze further the reasons for similarities or differences in fundamentals between companies and their sustainability.

Off-Balance Sheet Liabilities

One has to be vigilant in tracking the contingent liability vis-à-vis the size and net worth of the company along with analyzing various components of contingent liability. In this company’s case, contingent liability has been low as a percentage to net worth. Intuitively,

this is a positive indicator.

However, considering the scale of the company and its operations, such low contingent liabilities (Excise matters – Rs. 2.8 crores, Sales tax matters – Rs. 3.1 crores, Income tax matters – Rs. 24.7 crores, etc.) need checking.

Within the total consolidated contingent liability, approximately 60-70% of the total tax related contingent liabilities pertains to the standalone entity (India business).

From the additional check as above, it appears that other auto ancillary companies also have low contingent liabilities.

Also, the difference in contingent liability based on standalone disclosures and consolidated disclosures is small, indicating that contingent liabilities at subsidiaries levels are very low. Considering the complex corporate structure and multiple geographies involved, one may want to be additionally cautious in this regard.

These are some of the points that may be relevant for investors to know and understand the risks that they are taking. The gravity of some other issues may not be much and further clarification from the management may even resolve them. We have tried contacting the

company to get some clarifications on the above-mentioned points and are still awaiting a reply.

Overall, investors will have more certainty about the risks that they are entering into. And all this is possible by looking at Quality of Earnings and Corporate Governance issues systematically.

Amogh Korde, Project Lead – Behavioural and Fund Analytics at Multi-Act, delves into the ever-evolving investment landscape … Continued

Read more

When I consider PSU stocks, I’m reminded of the famous song of Bob Dylan, “The Times They … Continued

Read more

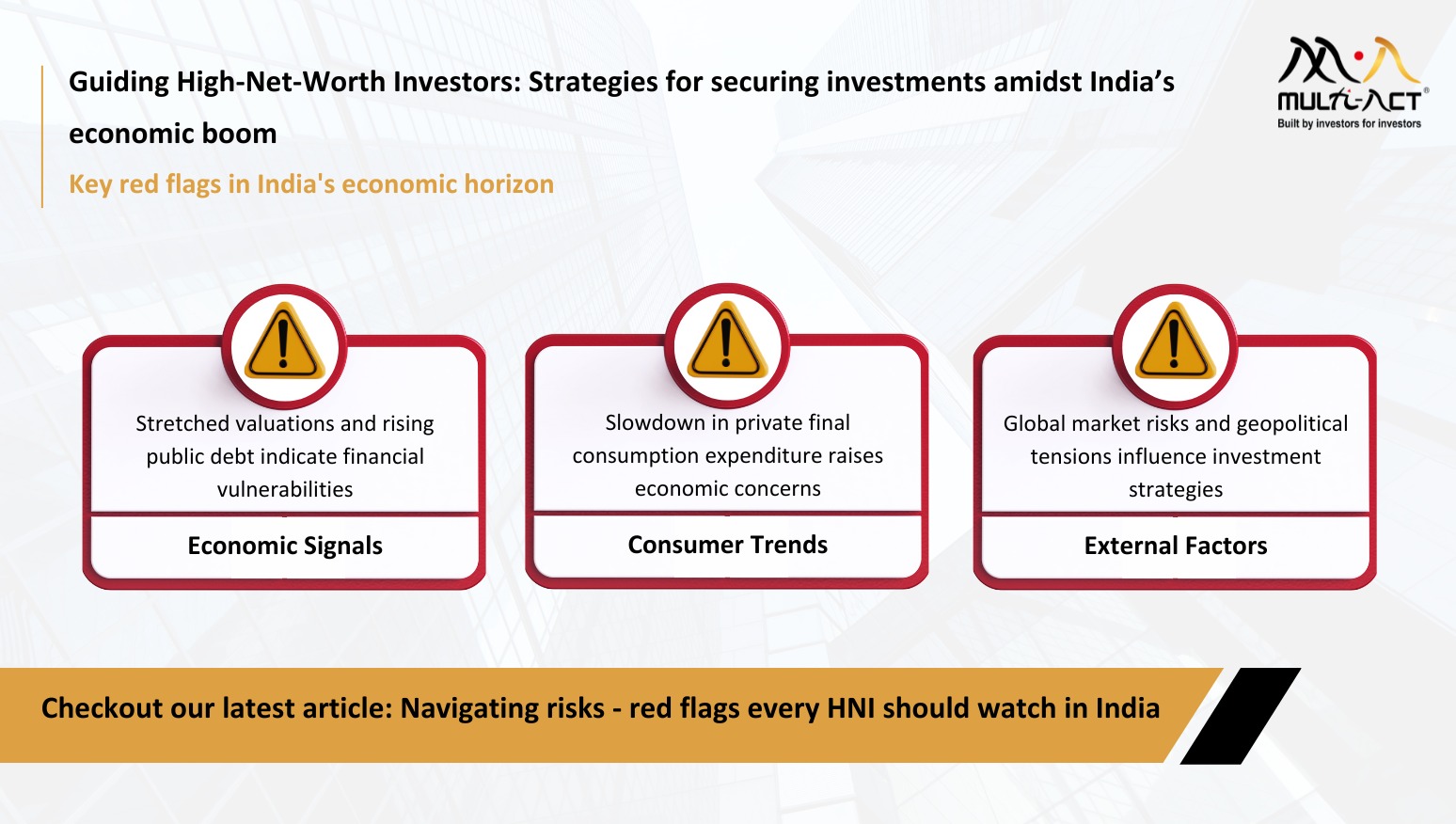

The Indian economy is on a promising trajectory, with expectations of robust GDP growth surpassing 6.5% in … Continued

Read moreReceive monthly updates by signing up to our newsletter.

| Sr. No. | Received from | Pending at the end of last month | Received | Resolved* | Total Pending # | Pending complaints > 3 months | Average Resolution time^ (in days) |

|---|---|---|---|---|---|---|---|

| 1 | Directly from Investors | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | SEBI (SCORES) | 0 | 0 | 0 | 0 | 0 | 0 |

| 3 | Other Sources (if any) |

0 | 0 | 0 | 0 | 0 | 0 |

| Grand Total | 0 | 0 | 0 | 0 | 0 | 0 |

Trend of Monthly Disposal of Complaints

| Sr. No. | Month | Carried forward from previous month | Received | Resolved* | Pending# |

|---|---|---|---|---|---|

| 1 | April 2023 | 0 | 0 | 0 | 0 |

| 2 | May 2023 | 0 | 0 | 0 | 0 |

| 3 | June 2023 | 0 | 0 | 0 | 0 |

| 4 | July 2023 | 0 | 0 | 0 | 0 |

| 5 | August 2023 | 0 | 0 | 0 | 0 |

| 6 | September 2023 | 0 | 0 | 0 | 0 |

| 7 | October 2023 | 0 | 0 | 0 | 0 |

| 8 | November 2023 | 0 | 0 | 0 | 0 |

| 9 | December 2023 | 0 | 0 | 0 | 0 |

| 10 | January 2024 | 0 | 0 | 0 | 0 |

| 10 | February 2024 | 0 | 0 | 0 | 0 |

| 11 | March 2024 | 0 | 0 | 0 | 0 |

Grand Total |

0 |

0 |

0 |

0 |

Trend of Annual Disposal of Complaints

| Sr. No. | Year | Carried forward from previous year | Received | Resolved* | Pending# |

|---|---|---|---|---|---|

| 1 | 2019-20 | 0 | 0 | 0 | 0 |

| 2 | 2020-21 | 0 | 0 | 0 | 0 |

| 3 | 2021-22 | 0 | 0 | 0 | 0 |

| 4 | 2022-23 | 0 | 0 | 0 | 0 |

| Grand Total | 0 | 0 | 0 | 0 |